Considering that Bitcoin ATMs are very young in the industry, the challenges have changed over the years. At first, the biggest challenge was explaining to regular people what Bitcoin is and why they should hold even just a bit of it. Today, a lot of people have heard about Bitcoin and numerous of them have at least some understanding of what it is and how it works. New challenges, like in any new industry, are still present. Over the years, many of the challenges have been resolved through technology. Many states have a clear stand on Bitcoin now, especially now that we have wallet forensic tools at our disposal, and KYC/AML as a standard for anything crypto.

By addressing each issue individually, the industry is slowly but surely overcoming the obstacles that stand before it, which could possibly result in easier operations and more mature industry standards.

If you are wondering what it takes to become a part of the crypto ATM operators in the country, keep on reading below.

Bitcoin ATM Challenges

Having a crypto ATM may seem simple as investing in your business, but there is more to it than just purchasing a machine and placing it at the local gas station or a food mart. These include banking challenges, often lack of knowledge of the industry, lack of information on needed initial capital, and understanding of regulations and compliance importance.

But, just like any challenge, there is always a solution.

Challenge #1: Banking Issues

Finding a banking partner to handle Bitcoin ATM transactions can be a challenge because many banks simply do not bank MSB businesses. While this is not a “Bitcoin” issue but a fact that Bitcoin ATMs generate large cash volumes and many banks simply refuse to bank MSB businesses. Frankly, it may take several attempts to find a proper banking partner.

Solution to Banking Issues

Operators should work closely with banks they already have connections with in order to successfully conduct bitcoin ATM services.

There are banks that offer banking services for bitcoin ATM companies, and they require extensive often specific compliance implementation.

Challenge #2: Lack of Knowledge (Especially on AML/KYC Compliance )

Due to limited access to lawyers with working knowledge of Bitcoin ATM KYC/AML compliance, as well as regulation, and the lack of training material available for operators, it’s not always easy to fully understand the industry and KYC/AML in the BTM space.

Operators must also be prepared for third-party reviews regarding their KYC/AML business practices.

Solution to Lack of Knowledge (Especially on AML/KYC Compliance)

To ensure proper adherence to regulations, operators should seek out companies specilized in Bitcoin ATM compliance, or lawyers with working knowlege on the matter. There are several companies like BTM compliance that can provide you with KYC/AML program and necessary trainings.

Companies can also look for legal advice from knowledgeable lawyers who specialize in dealing with bitcoin ATMs specifically.

Challenge #3: Capital Needed To Operate

Frankly, crypto ATMs work differently than traditional ATMs. The customer does not need a bank account but rather a digital wallet. All the customer needs to do to buy Bitcoin is to have their Bitcoin wallet with them and they can start buying or selling Bitcoin or any cryptocurrency of their choice.

In order for operators to run their crypto ATMs successfully, they must have sufficient Bitcoin at their disposal in order to fulfill customers’ orders. This means that operators must have enough Bitcoin in their wallets to fulfill customer purchases. Also, operators need to collect the cash that the customer has inserted into the machine and turn it back to Bitcoin (or store it on their exchange account) so that they can replenish the Bitcoin in stock.

This process requires considerable floating capital due to long processing times, which could span anywhere from two to seven days depending on various factors such as how often the operator emotes the machines, bank processing times, etc.

ATM Operators should always aim to have enough Bitcoin ready beforehand for at least a week’s worth of operation so as not to get bogged down by operational delays caused by a lack of funds when fulfilling customer orders.

Solution To Capital Needed To Operate

Having sufficient capital at any given time is crucial for operators if they intend on operating their machines efficiently and without interruption due to insufficient funds or liquidity issues caused by delayed transactions or any other liquidity issue.

ChainBytes Bitcoin ATM back office software, allows operators to quickly replanish the stock of Bitcoin after the sell is made on the machine. Auto buy back option directly from the operator exchange will reduce the Bitcoin price flactuation risk and ensure that Bitcoin stock of the operator is always at the same level.

Challenge #4: Regulations in the USA

In terms of existing regulations surrounding crypto ATMs within America, there are several laws all operators must agree to within each respective jurisdiction/state before carrying out operations legally and safely within those areas:

On a federal level, all US-based operators must register themselves with FinCEN (Financial Crimes Enforcement Network) under Money Service Businesses guidelines alongside having an appropriate compliance program implemented alongside the role of a designated compliance officer.

Also, it is worth mentioning that operators MUST check on a state and local level if there are any additional requirements or regulations in their respective areas of operation. This is best done using a local attorney with experience in Bitcoin ATM operation. Some states, such as New York, have additional licensing requirements. New York is famous for being one of the hardest states to start an operation, all due to the license known colloquially as BitLicenses, which operators must obtain in order to operate legally in the state of New York.

Regulations remain ever-changing since it’s still an early industry.

Solution To Regulations in the USA

In terms of following American-based regulations surrounding Bitcoin ATMs, all potential operators should contact lawyer offices specializing in cryptocurrency-related matters with an emphasis upon familiarizing themselves more heavily with local state guidelines before attempting to start operation.

Hiring well-versed blockchain and Bitcoin ATM compliance companies will provide the necessary KYC/AML writen comliance program, help you with the FinCEN registration as well as provide you with the training material required for the operation.

Bottom Line

A Bitcoin ATM has the potential to revolutionize how people access and use cryptocurrencies, and while there are a few challenges that must be addressed, the industry is moving in the right direction and seeing exponential growth. The need for capital, understanding regulatory compliance requirements, and operational considerations need to be taken into account when starting a Bitcoin ATM business.

On the other hand, operators are charging anywhere between 12%-20% of transaction volume, making the Bitcoin ATM industry a very hot topic among investors who are looking into cash flow businesses.

By understanding Bitcoin ATM challenges in advance and preparing accordingly – such as securing banking relations, researching local regulations, creating a strong KYC/AML program, and filing for the FinCEN registration – operators can minimize their risk while maximizing their profits. Through careful planning and dedication to following best practices within the industry, entrepreneurs can find fast success when launching a Bitcoin ATM business.

With this newfound knowledge of what’s involved in setting up a shop successfully at any given location across America now, you should feel more confident about taking your next steps toward becoming part of this ever-expanding yet exciting new sector.

Become Part of the Crypto ATM Operators Today with ChainBytes

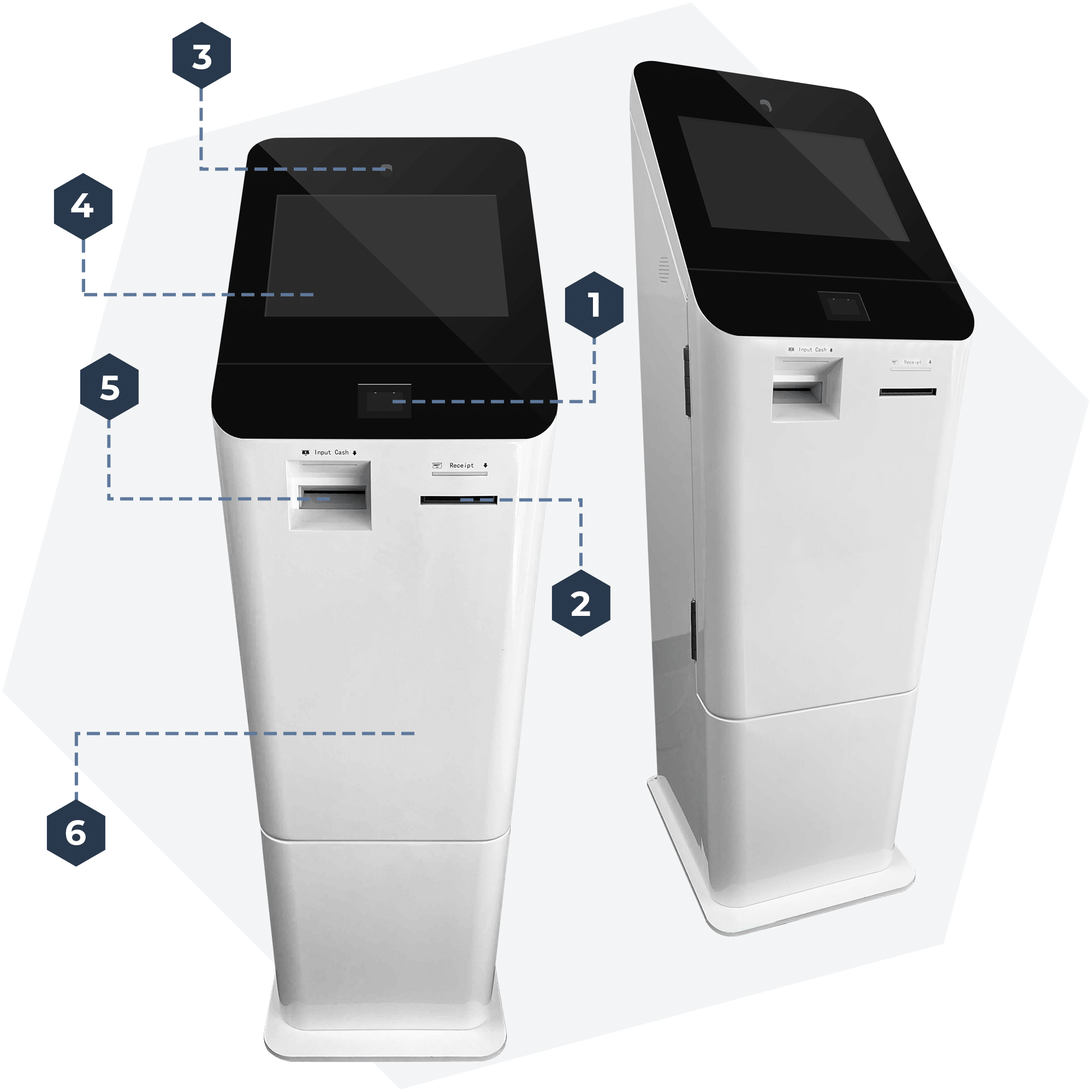

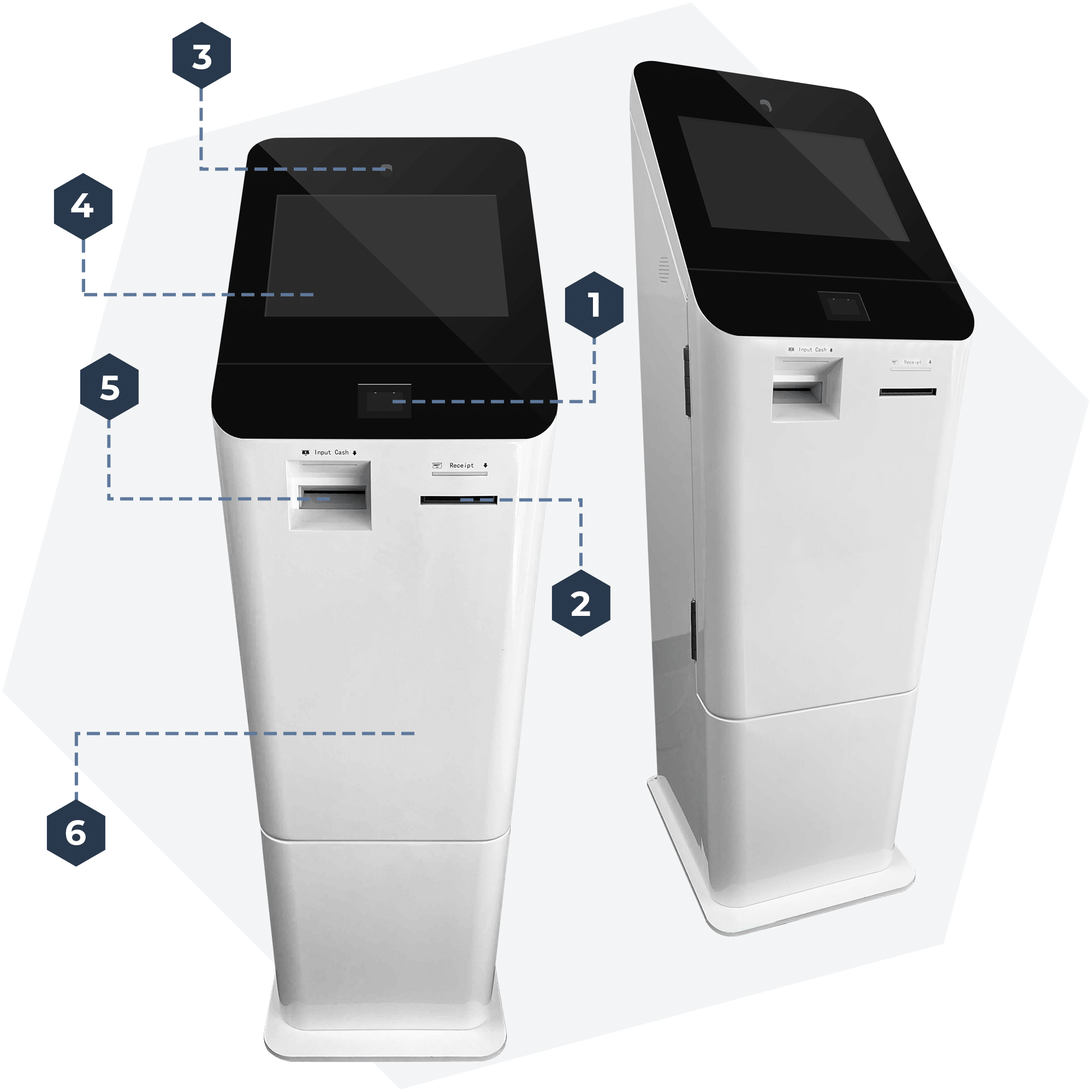

Do you want to become part of the exciting Bitcoin ATM business? ChainBytes is here to help in making you a fully-fledged crypto ATM operator. Our company is a crypto ATM provider that will have the models you need.

Our machines adhere to BTM compliance so that you can stay within legal boundaries while conducting operations safely and securely.

With our experience, knowledge, and the best software and hardware in the industry, we’ll ensure your success when launching a Bitcoin ATM business. Start today with ChainBytes and become the crypto provider that people need for access to cryptocurrencies!

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Bitcoin ATMs and Digital Inclusion: Empowering the Underbanked and Unbanked

Introduction As our global financial system continues to transform, spurred by the advent of financial technology, there's a rising focus on bringing cryptocurrency to all corners of society. However, a significant portion of the population - the underbanked and...

Navigating the World of Bitcoin ATMs: A Comprehensive Guide to Dos and Don’ts

Introduction As the world of cryptocurrency expands, so does the infrastructure supporting it. Bitcoin ATMs have become one of the most sought-after services in the cryptocurrency ecosystem. With over 19,000 Bitcoin ATMs operating globally, it's crucial to know how to...

Negotiating Prime Rent for Your Bitcoin ATM: A Smart Investment

Learn about rent prices for Bitcoin ATM locations and how to negotiate the rent with potential store owners. In this article, we are bringing the best practices for renting a Bitcoin ATM location.

Order a Bitcoin ATM

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700