Introduction

As the world of cryptocurrency expands, so does the infrastructure supporting it. Bitcoin ATMs have become one of the most sought-after services in the cryptocurrency ecosystem. With over 19,000 Bitcoin ATMs operating globally, it’s crucial to know how to use them safely and effectively. Whether you’re a seasoned crypto enthusiast or just starting, this guide will cover the do’s and don’ts when using Bitcoin ATMs.

Understanding Bitcoin ATMs

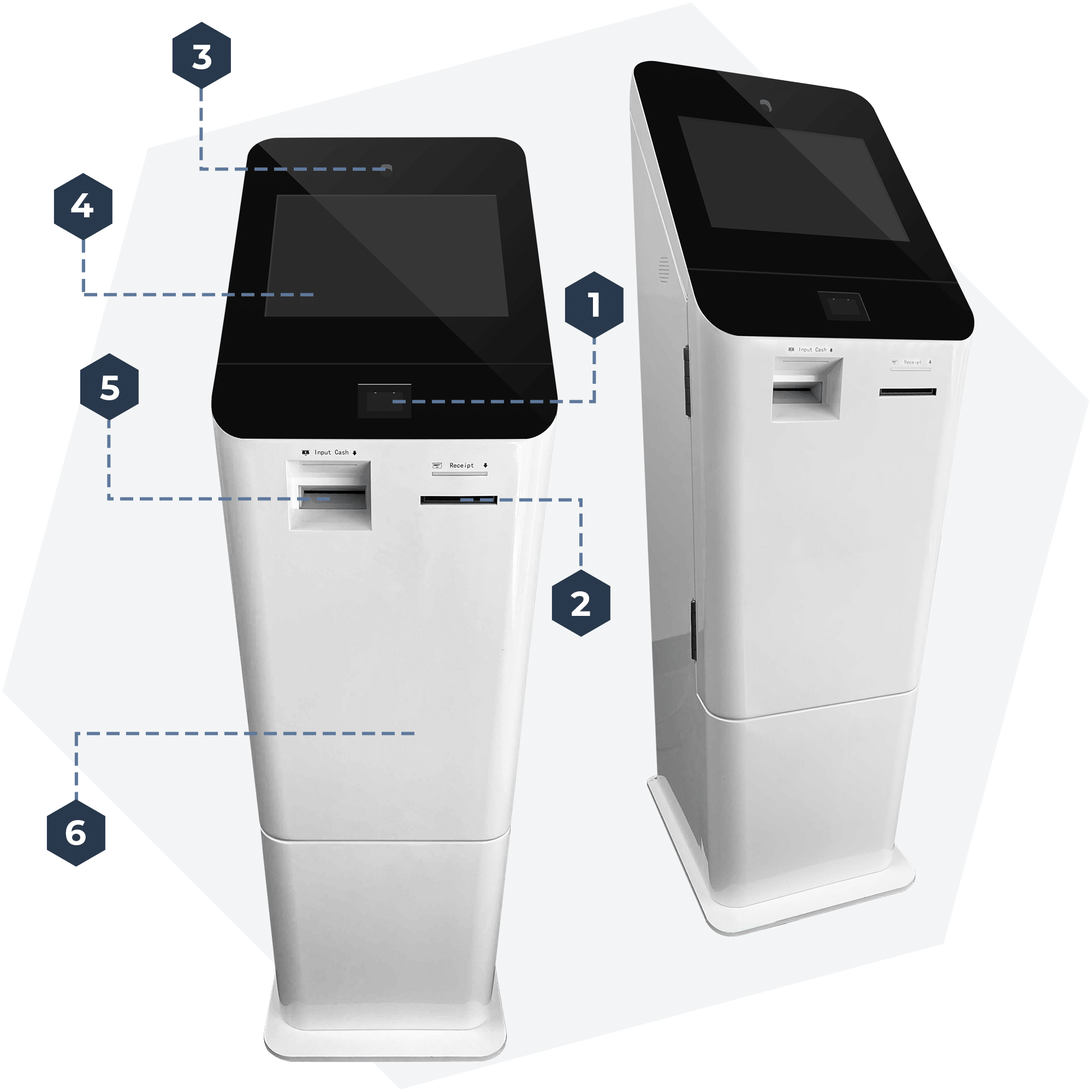

What is a Bitcoin ATM and how does it work?

A Bitcoin ATM allows users to buy or sell Bitcoins using cash. They’re similar to regular ATMs, but instead of dispensing money, they facilitate buying or selling Bitcoins.

The process of using a Bitcoin ATM is quite simple:

- Selection of Transaction: Choose between buying or selling Bitcoins.

- Insert wallet where you will receive the crypto: Scan your digital wallet’s QR code (ensure that wallet belongs to you personally).

- Completion of Transaction: Insert cash for buying bitcoin, or follow on-screen instructions for selling it for cash.

- Click Done and collect receipt: Collect the receipt and crypto will be on the way to your wallet.

Different types of Bitcoin ATMs:

- Buy-Only ATMs: ATMs where users can only buy Bitcoins.

- Two-Way ATMs: Supports both buying and selling transactions.

Remember that Bitcoin ATMs typically have higher transaction fees, averaging 14-20%, compared to online exchanges.

Why Customers Use Bitcoin ATMs and Benefits of Using Bitcoin ATMs

Ease of Use and Convenience

Bitcoin ATMs provide users with a simple and straightforward way to buy and sell Bitcoins instantly and locally, making them a popular choice among those new to cryptocurrency, or those not tech-savvy individuals who are looking to easily procure the cryptocurrency. Unlike online exchanges, which can be complicated and time-consuming, Bitcoin ATMs allow users to quickly and easily complete transactions without the need for complex online registrations and processes.

Security of Data and Privacy

An additional notable benefit of utilizing Bitcoin ATMs pertains to the heightened degree of security they provide. Presently, all Bitcoin ATMs require some form of verification for larger transactions, which is usually a collection of identification, Social Security numbers, or phone numbers. For minor transactions, many operators decide to enable users to engage in Bitcoin buying and selling without disclosing too much of personal details, although a snapshot of the customer is captured during the transaction process. The data is collected directly at the machines, eliminating the need for online registrations. This attribute renders Bitcoin ATMs especially attractive to individuals who prioritize enhanced data security.

Do’s When Operating a Bitcoin ATM

1. Do Verify the location where the Bitcoin ATM is placed

When deciding where to place a Bitcoin ATM, it’s essential to choose a location that guarantees a safe environment for individuals carrying larger amounts of cash. You are looking for a well-lit location where customers would feel secure. The growing popularity of Bitcoin ATMs has led to Bitcoin ATMs showing up in various locations. Keep in mind that almost every store owner will be happy to host one of your Bitcoin ATMs for monthly rent payments for the space it occupies.

2. Do Understand the Fees

Bitcoin ATMs provide ease of use and they come with higher transaction fees! These fees are your profit, do research on the competition in your area and see how much are they charging. Often sites like CoinATMRadar are used by Bitcoin ATM operators to list their fees, but keep in mind that they are often not updated to reflect current fees, so it’s best to actually visit the competition to see their latest fees. Currently, we see that most of our operators are charging anywhere between 14-20%.

3. Do Secure Your Wallet

Security is paramount when dealing with cryptocurrencies. When starting a Bitcoin ATM operation, ensure your wallet is secure, and always have your keys safely stored in a secure place. With ChainBytes operators must use their own wallets and we do not store or hold operator funds. ChainBytes believes in a “Not your keys, not your wallet policy” therefore operating ChainBytes machine operators hold their funds and their keys.

4. Do secure an Exchanges

Bitcoin ATMs set their own fees, but it’s important to remember that Bitcoin is very volatile by its nature. Therefore it’s important to secure an exchange where you will be procuring Bitcoin needed for the operation. While some operators like to speculate on the price of Bitcoin and hope to make additional earnings from this volatility, it’s not always the best practice. With ChainBytes operators have a choice of using almost any reputable exchange and automatically buy back the bitcoin they have sold at the machines. Operators can connect their exchange account with the Dashboard and seamlessly buy back the bitcoin they have sold, ensuring the highest profit margin and minimizing bitcoin volatility risk.

5. Do Secure Banking

Your Bitcoin ATM will potentially be producing larger volumes of cash, you need a bank account where you will be depositing the cash. Finding a bank that is happy to bank Bitcoin ATMs is not an easy task, so it’s best to start forming a banking relationship as soon as you can.

Don’ts When Operating a Bitcoin ATM

1. Don’t Neglect Security Measures

Security should always be a top priority when operating a Bitcoin ATM. Avoid placing the ATMs in poorly lit or sketchy locations. Additionally, be wary of anyone who appears to be watching you closely during your cash collections. Taking these precautions will help protect your safety and your funds.

2. Don’t Forget KYC/AML Regulations

Compliance, compliance, and compliance! Bitcoin ATMs on a federal level are regulated by FinCEN and some states have additional requirements on the state level. Research Bitcoin ATM compliance. there are companies specializing in Bitcoin ATM compliance one of them is btmcompliance.com which can help you navigate the federal compliance requirements.

To start the operation of a Bitcoin ATM company in the USA, you will need a written AML/KYC program, a dedicated compliance officer, and you must register with FinCEN. There may be additional requirements so it’s always best to consult an expert.

3. Don’t fall for “If you build it, they will come.”

After placing the machine at the location it’s important to attract potential customers. Just placing the machine at a random store and hoping that it will produce profit will rarely work. You will want to promote your machine and use any available means to inform potential customers that there is a new Bitcoin ATM near them. Having a machine listed on Google Business is one of the important steps in marketing your machine. Google Business registration will place your machines on Google Maps expanding your reach and you will have a higher chance for potential customers to find you. Placing signage outside the store is also important, a simple Buy Bitcoin here sign outside of the store is a good start.

4. Don’t deploy machines before learning

When you receive your machine, ensure to learn about all the functionality. It’s important that you yourself learn how to buy or sell Bitcoin, how to use vouchers, and learn all you can! Go through the processes your customers will be experiencing when using the machines. This way you will understand what your customers are going through and be able to answer any questions they may have.

5. Don’t get too wrapped in small details

Starting a new business is never easy, and while you do want to learn about the operation and best industry practices (and master them all), it’s important not to get too wrapped in every tiniest detail. If you have secured a location for your machine, deploy it as soon as you can, the machine that sits in a garage is not producing income. So while it’s important to have a good signage to attract customers or have exchange secured, the design shade of the sign or securing 2nd and 3rd exchange is not of crucial importance. Always look at the big picture, work on how to attract customers, and never stop learning about the business.

Common Bitcoin ATM operator queries

- Location warmup: Like in every business it takes time to attract new customers, so it may be a bit before you see the first customer using your machine, this is normal. Local restaurants don’t get customers on day one after the opening. So be patient and market your location, place signs at the store, look into billboards or simple outdoor advertising possibilities, promote your machines online, and inform potential customers that you arrived in the neighborhood and are happy to serve them.

- Armour car services: You can hire the armored car services to empty your machines, and the prices are quite affordable.

- Installation process: At ChainBytes, we are doing all the software installations and updates remotely. All that you need to do is turn on the machine and connect to the internet, and our deployment team will do the rest. Installation process takes under an hour.

- Program experience: We made owning and operating ChainBytes machine easy. You do not need any technical or programming experience. Our machines are user-friendly and turn key.

Future Prospects of Bitcoin ATMs

With cryptocurrency’s growing acceptance, Bitcoin ATMs have become more prevalent. As the market matures, we expect to see a progressive increase in customers using the machines.

Frequently Asked Questions

- Is it the right time to start a Bitcoin ATM business?

If you ask us we would say yes. We got this question a lot over the years and our answer never changed. The market is growing, people are more and more interested in participating in the digital currency space and there are not enough Bitcoin ATMs. New machines are deployed daily and the market is still far from saturation, if any there are not enough of these machines in the USA. There are still people who travel anywhere from 30 minutes to an hour and more to use one of these machines.

- How do I find a Bitcoin ATM near me?

Use online resources like CoinATMRadar or Google Maps.

- Can customers use Bitcoin ATMs without a mobile wallet?

Yes, ChainBytes machines offer the option for the customers to use a paper wallet.

- Are there any specific regulations for Bitcoin ATMs?

To start operation all bitcoin ATM operators in the USA must be registered with FinCEN and have a KYC/AML program as well as a compliance officer. Some states as New York have additional requirements, so it’s essential to be aware of federal, local, and state regulations.

- What is the typical transaction fee for a Bitcoin ATM?

Fees can vary, the current trend shows an increase in fees, and currently, we see operators charging anywhere between 14%-20%

Conclusion

As Bitcoin continues to gain popularity, there’s an increasing need for Bitcoin ATMs. By following the do’s and don’ts outlined in this guide, you can navigate the world of Bitcoin ATM operation. Remember to keep your private keys secure, stay aware of regulations, and market your machines. Happy operations!

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Webinar Highlights: How To Start & Grow Your Bitcoin ATM Venture

Wrapping up the year with our final webinar, we took a moment to reflect on an engaging session filled with insights and opportunities. As Bitcoin recently surpassed the monumental $100k mark, interest in the cryptocurrency industry is soaring, making now an ideal...

Tips for Seamless Customer Support in the Bitcoin ATM Business

Effective customer support is crucial for any business, and the Bitcoin ATM industry is no exception. With the growing popularity of cryptocurrency, users increasingly rely on Bitcoin ATMs for quick and easy transactions. However, as with any new technology, customers...

Key Considerations for Investing in Cryptocurrency ATMs

In the evolving world of finance and technology, cryptocurrency ATMs are becoming increasingly popular. These machines offer a tangible interface between the digital and physical realms of finance, allowing users to buy and sell cryptocurrencies with ease. As an...

Order a Bitcoin ATM

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700