In the ever-evolving landscape of cryptocurrencies, one avenue that has gained significant attention is the Bitcoin ATM business. As digital assets continue to reshape the financial industry, entrepreneurs are exploring innovative ways to capitalize on the growing demand for convenient and accessible cryptocurrency services. In this blog post, we will delve into the intricacies of the ATM business, examining its profit potential and addressing the question on many minds: Are Bitcoin ATMs profitable?

Understanding the Bitcoin ATM Business Landscape

Let’s break down the business of Bitcoin ATMs in simpler terms. This business is about making machines that feel familiar like regular ATMs but are designed specifically for cryptocurrencies like Bitcoin. Companies, such as ChainBytes, are important in this area because they make it easy for people to buy and operate Bitcoin ATMs. These machines act as a connection between the users and the new world of cryptocurrencies. They give people a real and easy way to deal with digital money.

ChainBytes Overview: Pioneering Excellence in Cryptocurrency Solutions

ChainBytes stands as a leading force in the world of Bitcoin ATMs. As a trusted provider, our commitment to excellence shines through in every aspect of our business. We take pride in crafting the highest quality kiosks, ensuring that each machine reflects our dedication to reliability and innovation. Our mission goes beyond merely producing ATMs; we aim to simplify the entire process of buying and operating Bitcoin ATMs while providing cutting-edge software solutions.

Business Models and Revenue Streams of Bitcoin ATM

For B2C businesses venturing into the Bitcoin ATM industry, understanding the diverse business models and revenue streams is essential for success. Bitcoin ATMs generate revenue through several channels:

- Transaction Fees: Bitcoin ATM operators charge transaction fees for buying or selling cryptocurrency. These fees are set by the operators of the machines themself and can vary based on factors like location.

- Rent and sharing the revenue: Some Bitcoin ATM operators offer a profit split to locations where the ATM is placed, but in most cases, operators offer a fixed rent paid monthly to the locations hosting a machine.

- Advertising and Sponsorship: Operators can monetize Bitcoin ATMs by offering advertising space on the machines or partnering with sponsors. The top screen attached to the machine is valuable realistic space that can be sold for advertising, securing additional revenue streams.

- Hardware Sales: Many operators expand their operations and become resellers of the machines, profiting from reselling hardware.

By leveraging these revenue streams, businesses can establish profitable partnerships in the Bitcoin ATM industry, tapping into the growing demand for cryptocurrency transactions.

Are Bitcoin ATMs profitable?

Now, let’s address the central question: Are Bitcoin ATMs profitable? The answer lies in various factors, and operators need to carefully consider each element to unlock the full profit potential of their business.

1. Location, Location, Location:

The success of a Bitcoin ATM business is heavily influenced by the choice of locations for machine placement. High-traffic areas with a target audience interested in cryptocurrencies can significantly impact transaction volumes.

Busy shopping malls, airports, and urban centers are not prime locations as many would believe, but instead local grocery stores, gas stations as well as community hubs tend to have better volumes due to ease of access and often perceived higher security.

Finally, Think about it, would you walk into the mall with several thousand in cash in your pocket? If the answer is no, then you know that that is not the best location for your ATM.

2. Regulatory Compliance:

Adherence to local regulations is paramount in the cryptocurrency space. Bitcoin ATM operators must comply with a regulatory environment, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements as well as any other local regulations. Furthermore, this adds a layer of complexity, it also instills confidence in users and regulators, fostering a secure and trustworthy ecosystem.

3. Marketing and Awareness:

Creating awareness about the presence of Bitcoin ATMs is crucial for attracting users. Strategic marketing initiatives, both online and offline, can play a pivotal role in driving foot traffic to these machines. Education about the benefits of cryptocurrencies and the ease of use of Bitcoin ATMs can contribute to increased adoption.

4. Technological Innovation:

Staying ahead in the cryptocurrency industry requires a commitment to technological innovation. Bitcoin ATM providers like ChainBytes continuously enhance their machines, incorporating features such as AI features, advanced KYC, reporting, and real-time transaction tracking. These advancements not only improve operator experience but also position operators as leaders in the evolving market.

5. Market Trends and Volatility:

The cryptocurrency market can change a lot, and it’s known for being sometimes unpredictable. People who run Bitcoin ATMs need to keep an eye on these changes and use features like auto buy-back front the exchanges, allowing them to minimize price volatility risks. Even though the ups and downs in the market can be a bit tricky, they also offer a chance for more people to use ATMs when there’s a lot of interest in cryptocurrencies.

Are Bitcoin ATM Machines Profitable?

Thinking about the things we talked about, Bitcoin ATMs can make money for people who run them if they plan things out well. It’s not just about buying the machines; it’s also about getting them to different places and making sure they work smoothly for people to use. So, if operators think carefully and plan smartly, they have a good chance of making a profit in the Bitcoin ATM business.

Unlocking Profit Potential:

The profitability of a Bitcoin ATM from a business perspective hinges on factors such as location selection, regulatory compliance, marketing efforts, technological innovation, and adaptability to market trends. Operators who invest time and resources in these areas position themselves to unlock the full profit potential of their Bitcoin ATMs.

Addressing Profitability Concerns: Are Bitcoin ATM Machines Profitable?

Now, let’s delve deeper into the question that’s on the minds of many prospective Bitcoin ATM operators: Are Bitcoin ATM machines profitable?

The profitability of Bitcoin ATM machines is not a guaranteed outcome; it’s a dynamic aspect influenced by various factors. Let’s break down the key considerations:

1. Operating Costs and Revenue Balance:

Profitability begins with a comprehensive assessment of operating costs. Operators must factor in expenses such as machine acquisition, maintenance, rent for hosting locations, regulatory compliance, and ongoing expenses.

Balancing these costs against revenue generated through transaction fees, ATM placement partnerships, and other income streams is essential. The goal is to ensure that the revenue consistently outweighs operating expenses.

2. Transaction Volumes and Location Impact:

The number of transactions facilitated by a Bitcoin ATM directly correlates with its revenue potential. High-traffic locations with a target audience interested in cryptocurrencies can significantly impact transaction volumes. Strategic placement in busy areas can attract users looking for convenient access to digital assets. Regularly analyzing transaction data and adjusting strategies based on location performance is vital for optimizing profitability.

3. Market Conditions and Adaptability:

The cryptocurrency market is known for its volatility. Operators must remain adaptable to market conditions, adjusting transaction fees and other strategies to align with the dynamic nature of digital asset prices.

Keeping a finger on the pulse of market trends allows operators to proactively respond to shifts in user behavior, regulatory changes, and overall industry developments. Flexibility is key to thriving in the ever-evolving landscape of cryptocurrencies.

4. Continuous Innovation, Marketing, and User Experience:

Bitcoin ATM operators must stay ahead by embracing technological advancements.

Continuous innovation, whether through marketing efforts, additional cryptocurrency support, or enhanced user interfaces, not only attracts users but also positions the business as a leader in the industry. A positive and seamless user experience fosters loyalty and repeat transactions.

To Sum Up!

In conclusion, while the profitability of Bitcoin ATM machines is not a guaranteed outcome, it is achievable through a strategic and well-informed approach. By assessing operating costs, adapting to market conditions, ensuring regulatory compliance, embracing innovation, and prioritizing user experience, operators can unlock the profit potential inherent in the Bitcoin ATM business.

Moreover, It’s a journey that requires diligence, adaptability, and a keen understanding of the ever-changing dynamics of the market.

Explore our range of Bitcoin ATMs and start your business in under 30 days with ChainBytes.

Order a Bitcoin ATM

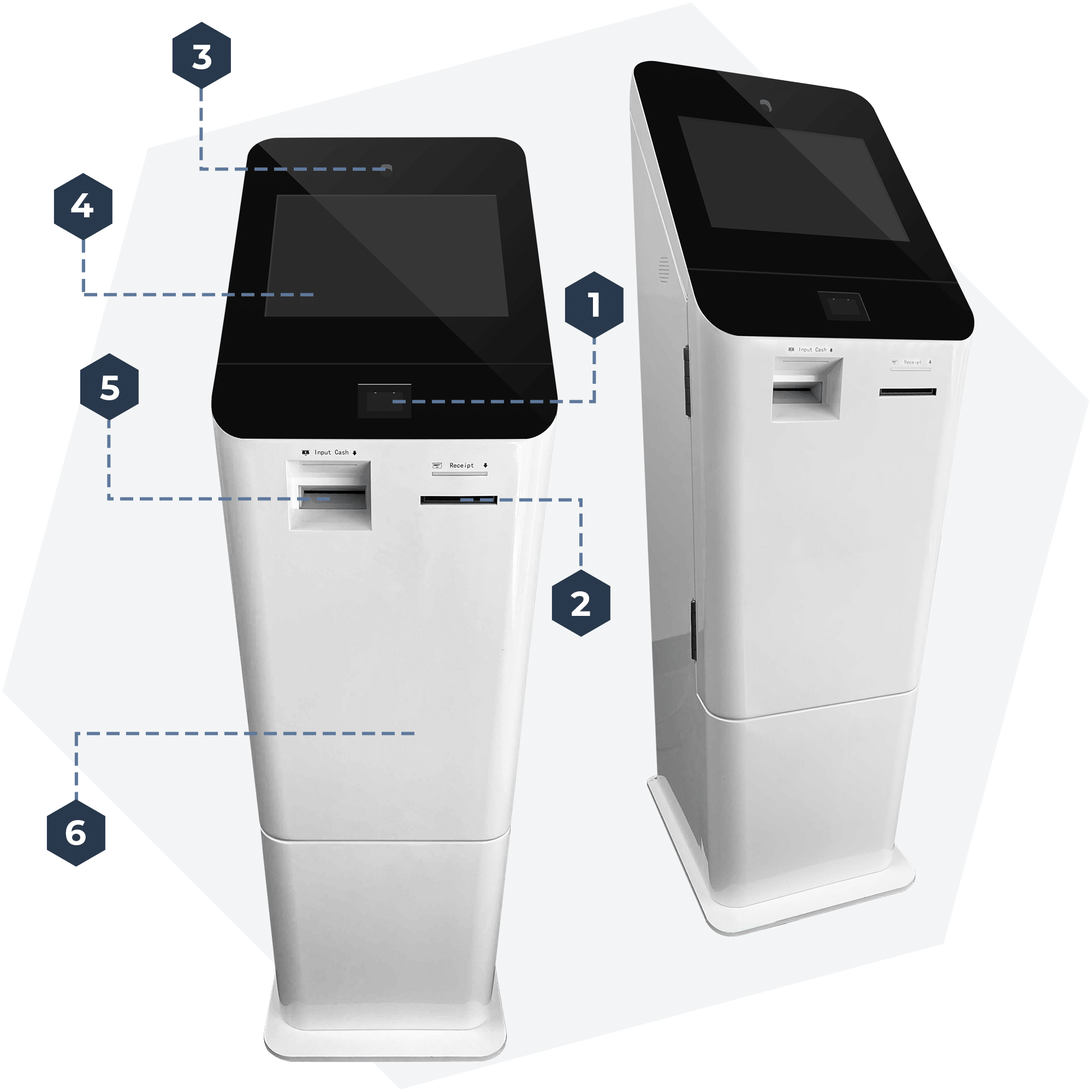

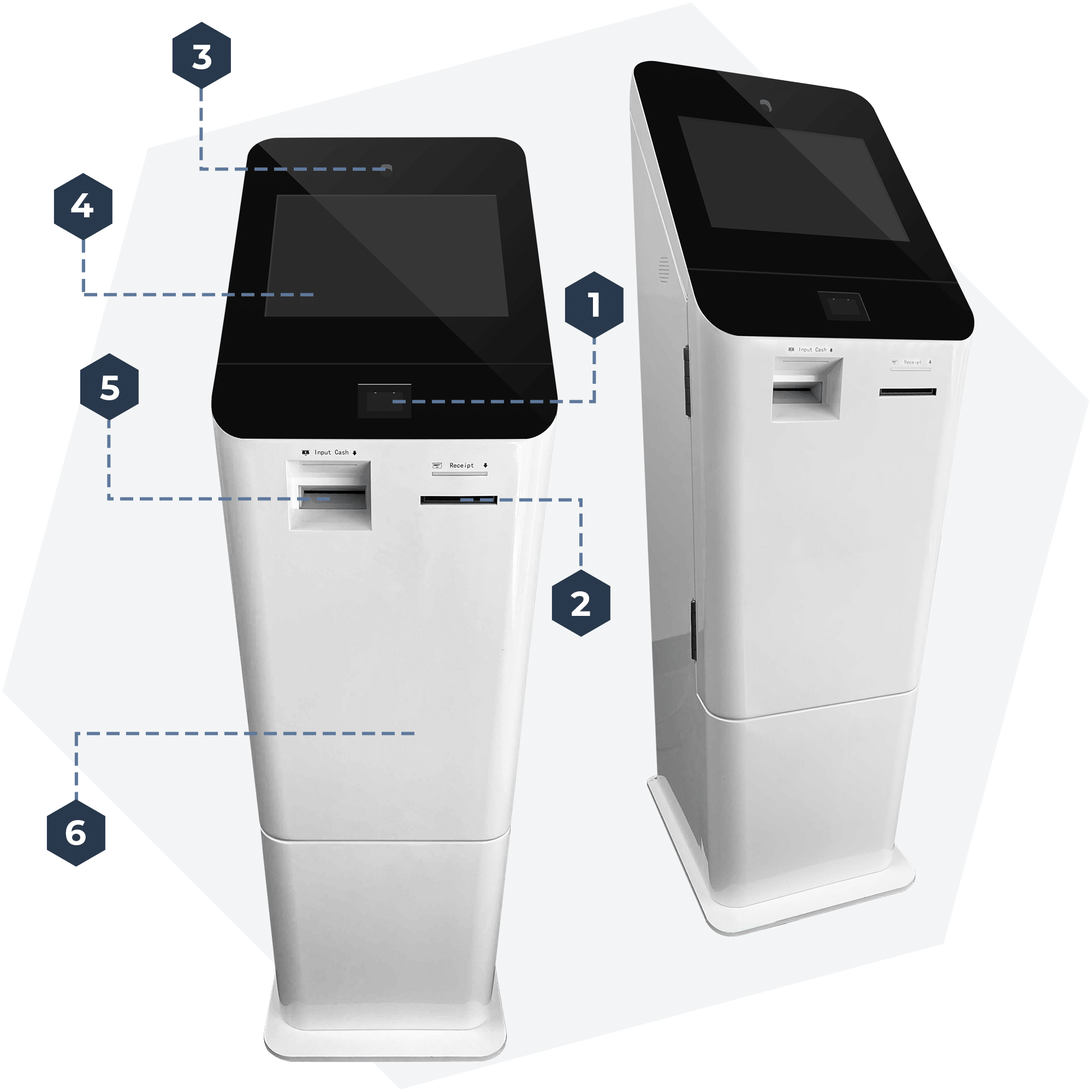

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Webinar Highlights: How To Start & Grow Your Bitcoin ATM Venture

Wrapping up the year with our final webinar, we took a moment to reflect on an engaging session filled with insights and opportunities. As Bitcoin recently surpassed the monumental $100k mark, interest in the cryptocurrency industry is soaring, making now an ideal...

Tips for Seamless Customer Support in the Bitcoin ATM Business

Effective customer support is crucial for any business, and the Bitcoin ATM industry is no exception. With the growing popularity of cryptocurrency, users increasingly rely on Bitcoin ATMs for quick and easy transactions. However, as with any new technology, customers...

Key Considerations for Investing in Cryptocurrency ATMs

In the evolving world of finance and technology, cryptocurrency ATMs are becoming increasingly popular. These machines offer a tangible interface between the digital and physical realms of finance, allowing users to buy and sell cryptocurrencies with ease. As an...